Table of Content

Tastyworks does not warrant the accuracy or content material of the products or services provided by projectfinance or this web site. Projectfinance is independent and isn't an affiliate of tastyworks. Chris Butler acquired his Bachelor’s degree in Finance from DePaul University and has 9 years of expertise within the financial markets. The thesis with the commerce was that FB was more likely to push greater and I had a revenue target of $190.

The only distinction is that the investor doesn't personal the underlying inventory, but the investor does personal the proper to purchase the underlying stock. The final steps involved on this course of are for the dealer to ascertain an exit plan and properly handle their danger. Proper position size will assist to manage threat, however a trader also wants to make certain they've an exit technique in thoughts when taking the trade.

The Lengthy Calendar Spread

Some traders like to carry the long call as a stand-alone commerce after the brief call expires. Looking at this example on AXP, the inventory would need to have a 30% down move or 25% up move earlier than struggling the maximum loss. With a calendar spread, the underlying stock would need to make a moderately large move for the commerce to suffer a full loss. Early project additionally adjustments the strategy from a calendar unfold to a synthetic long put when you don’t already personal shares, because you are quick a inventory and long a name, which is a very completely different outlook. There are a couple of trading tips to contemplate when trading calendar spreads. This strategy can be utilized to a stock, index, or trade traded fund .

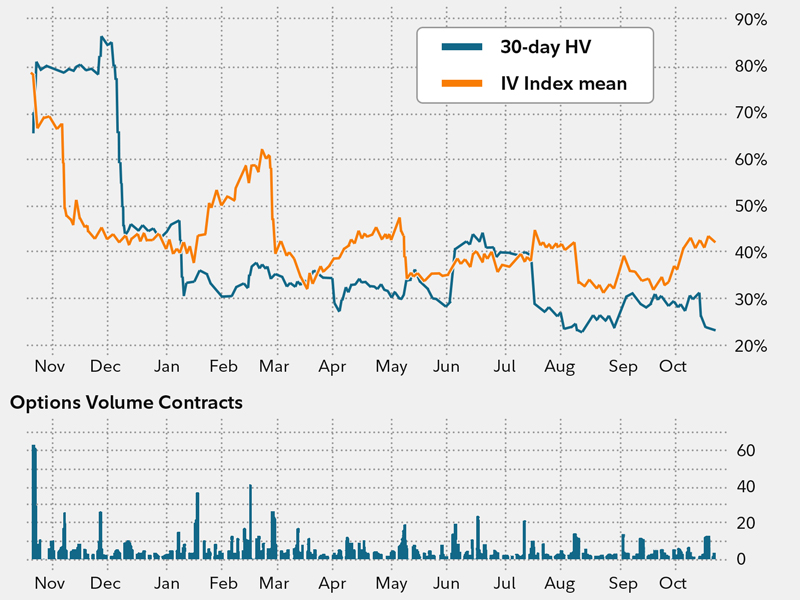

Calendar spreads are most profitable when the underlying inventory remains pretty constant and doesn’t make any drastic strikes in both path until after the expiration of the near-month option. However, my opinion is that lengthy calendar spreads arenotlong volatility trades. That’s an excellent situation for calendar spreads where you might be selling excessive vol and buying lower vol.

Supplemental Content Material

Calendar spreads could be the way to go if you’re looking for a low capital requirement technique . But don’t forget the necessities – having a impartial directional assumption on an asset with low volatility and a inventory value that you just assume won’t move around too much. How to promote calendar spreads on stocks that are announcing earnings today. I can’t offer you any specific advice since I can’t assess your position from the knowledge given.

However, for the most effective outcomes, a dealer would possibly think about a liquid vehicle with slender spreads between bid and ask costs. For our example, we use the DIA, which is the ETF that tracks the Dow Jones Industrial Average. Since this could be a debit unfold with defined danger, we don’t normally handle it. We are comfortable with the debit paid as max loss, and there’s not a lot we will do with these spreads regardless since they share the same strike.

As it stands, the utmost loss in this commerce is the net debit of $2.fifty four. If the inventory value begins sharply shifting away from the strike value, the distinction between the calls will approach zero and the full amount that was paid for the spread is misplaced. This is the goal of maximum profit as a end result of the long name has maximum time value when the inventory worth is similar as the strike worth. By this, we mean that traders might plan their position sizes across the maximum commerce loss and try to cut losses short as soon as they deem that the trade not falls within their forecast’s scope. Options AI, Inc isn't a broker-dealer, doesn't provide funding, tax or authorized recommendation and doesn't endorse or advocate the acquisition or sale of any explicit security or buying and selling strategy.

Let’s go through a couple of examples of calendar spreads and see how they progressed over the course of the trade. Generally talking a volatility spike will influence shorter-term options much more than longer-term choices. Leading into expiration, if the stock is trading just above or simply below the quick call, the dealer has expiration threat. Looking at the SPY instance above, the place begins with a vega of 16. This signifies that for every 1% rise in implied volatility, the trade ought to gain $16. If the position has constructive vega, it's going to profit from rising volatility.

The caveat is that the two choices can and possibly will trade at totally different implied volatilities. A long calendar spread is a impartial trading technique though, in some cases, it can be a directional buying and selling strategy. It is used when a dealer expects a gradual or sideways motion within the quick term and has extra path bias over the life of the longer-dated possibility.

I truly have at all times been thinking about stocks and this article opens my eyes to a new strategy. I love studying about new strategies and I even have never seen this one so I am trying ahead to researching it and studying extra about it to implement it. Thanks as well for communicating the chance for this technique and never just promote the upside.

It is important to seek out shares that historically do not make big moves after earnings bulletins and we can discover these using the Pre-Earn Options tab in Option Stalker. We additionally need to look at the every day chart for the inventory and we want to outline technical assist and resistance ranges that ought to keep the stock in a decent range. The morning after the earnings announcement you need to place an order to exit the spread at a pre-determined target profit between 20% and 40%. As long as you enter and exit the position as a variety your risk will always be limited to the debit you paid for the calendar unfold. The objective is to revenue from a impartial or directional inventory value move to the strike value of the calendar unfold with restricted danger if the market goes in the different path.

Long calendar spreads are good strategies to use when traders anticipate the price shall be near the strike value on the front-month option’s date of expiration. It can be applied by shopping for a longer-term name choice while promoting a shorter-term call possibility that’s at-the-money or barely out-of-the-money concurrently. Leg in — Traders who own calls or puts towards a inventory can promote an option towards the place and “leg” into a calendar spread anytime. Say a trader owns calls on a certain stock and it’s made a substantial transfer up however has lately leveled out, they will sell a name on the same inventory so long as they’re impartial over the short-term. This technique is great to allow merchants to experience out the dips in upward trending shares. A calendar spread sometimes entails shopping for and promoting the identical kind of possibility for a similar underlying safety on the same strike price, but at completely different expiration dates.

No comments:

Post a Comment